How Bankruptcy Attorney Near Me Tulsa can Save You Time, Stress, and Money.

The Greatest Guide To Chapter 7 Bankruptcy Attorney Tulsa

Table of ContentsTop Tulsa Bankruptcy Lawyers - The Facts7 Simple Techniques For Experienced Bankruptcy Lawyer TulsaBankruptcy Lawyer Tulsa - An OverviewBankruptcy Lawyer Tulsa Things To Know Before You BuyTulsa Bankruptcy Attorney Things To Know Before You Buy

The stats for the other main kind, Chapter 13, are even worse for pro se filers. Suffice it to say, talk with an attorney or 2 near you that's experienced with bankruptcy law.Many attorneys likewise use complimentary assessments or email Q&A s. Benefit from that. (The non-profit app Upsolve can assist you find totally free consultations, resources and lawful help cost free.) Ask if personal bankruptcy is certainly the best option for your situation and whether they assume you'll qualify. Prior to you pay to submit insolvency kinds and blemish your credit history record for as much as one decade, inspect to see if you have any type of sensible options like debt arrangement or non-profit credit rating therapy.

Ad Now that you've decided bankruptcy is undoubtedly the best program of action and you with any luck cleared it with a lawyer you'll need to get started on the paperwork. Prior to you dive into all the official bankruptcy kinds, you ought to obtain your own records in order.

Getting The Tulsa Bankruptcy Consultation To Work

Later down the line, you'll really need to prove that by divulging all kinds of info about your economic events. Here's a standard listing of what you'll require on the road in advance: Identifying files like your driver's permit and Social Security card Tax returns (as much as the previous four years) Evidence of income (pay stubs, W-2s, independent revenues, earnings from possessions along with any kind of income from federal government benefits) Bank statements and/or retirement account declarations Evidence of value of your possessions, such as car and realty valuation.

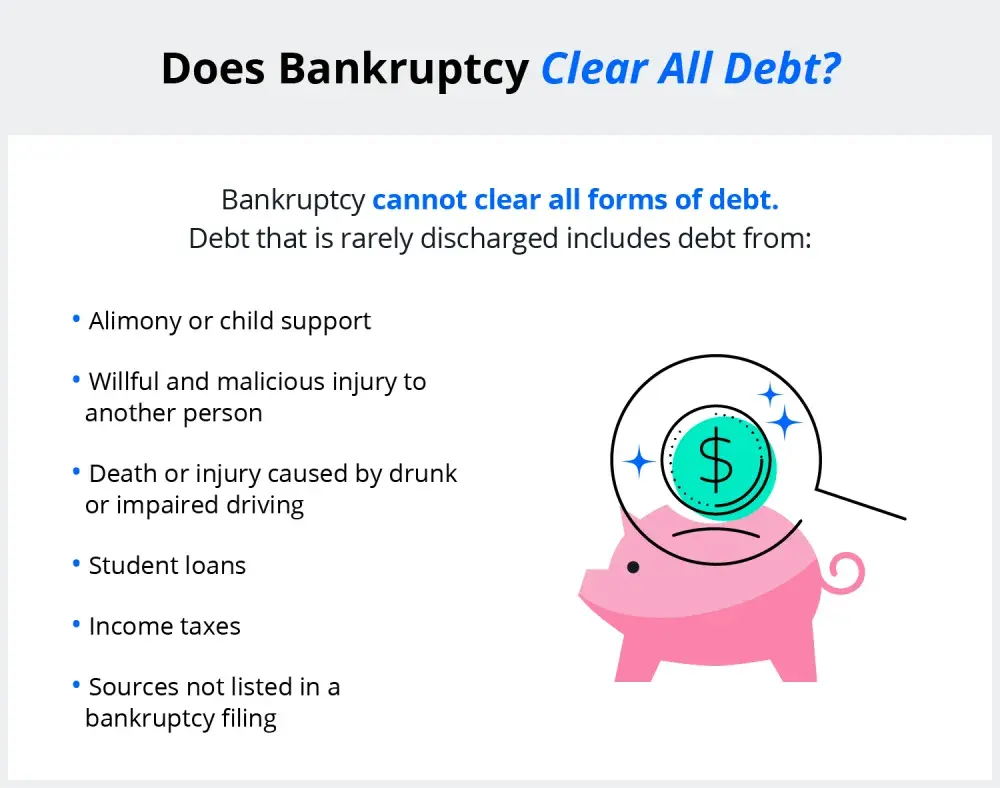

You'll want to recognize what type of debt you're trying to fix.

You'll want to recognize what type of debt you're trying to fix.If your income is as well high, you have another choice: Phase 13. This option takes longer to settle your financial debts due to the fact that it calls for a long-term repayment strategy typically 3 to 5 years prior to some of your staying financial debts are wiped away. The declaring process is also a great deal much more intricate than Chapter 7.

4 Easy Facts About Affordable Bankruptcy Lawyer Tulsa Described

A Chapter 7 bankruptcy remains on your credit scores report for ten years, whereas a Chapter 13 bankruptcy diminishes after seven. Both have lasting effect on your credit history, and any type of new financial debt you secure will likely include higher rate of interest. Prior to you submit your personal bankruptcy forms, you must first complete a required course from a credit rating counseling company that has actually been authorized by the Division of Justice (with the notable exemption of filers in Alabama or North Carolina).

The course can be completed online, in individual or over the phone. content You must finish the program within 180 days of declaring for insolvency.

Some Known Facts About Chapter 13 Bankruptcy Lawyer Tulsa.

A lawyer will normally handle this for you. If you're submitting on your own, recognize that there have to do with 90 various insolvency districts. Check that you're submitting with the proper one based on where you live. If your irreversible house has moved within 180 days of filling, you ought to file in the area where you lived the better section of that 180-day period.

Commonly, your personal bankruptcy lawyer will certainly deal with the trustee, but you may require to send out the person papers such as pay stubs, tax obligation returns, and savings account and charge card statements directly. The trustee who was simply appointed to your instance will certainly soon establish a required meeting with you, referred to as the "341 conference" due to the fact that it's a requirement of Section 341 of the U.S

You will need to supply a prompt checklist of what certifies as an exception. Exceptions might put on non-luxury, key lorries; necessary home items; and home equity (though these exceptions rules can differ widely by state). Any kind of property outside the listing of exemptions is thought about nonexempt, and if you do not give any kind visit the website of checklist, after that all your home is taken into consideration nonexempt, i.e.

You will need to supply a prompt checklist of what certifies as an exception. Exceptions might put on non-luxury, key lorries; necessary home items; and home equity (though these exceptions rules can differ widely by state). Any kind of property outside the listing of exemptions is thought about nonexempt, and if you do not give any kind visit the website of checklist, after that all your home is taken into consideration nonexempt, i.e.The trustee would not sell your sports cars and truck to promptly settle the lender. Rather, you would certainly pay your creditors that quantity over the training course of your layaway plan. A typical misunderstanding with insolvency is that as soon as you submit, you can stop paying your financial debts. While bankruptcy can assist you erase a number of your unsecured financial obligations, such as past due medical expenses or personal lendings, you'll wish to maintain paying your monthly payments for secured financial obligations if you want to keep the property.

Top-rated Bankruptcy Attorney Tulsa Ok Fundamentals Explained

If you're at threat of repossession and have tired all various other financial-relief choices, after that applying for Phase 13 may delay the repossession and help conserve your home. Ultimately, you will still require the revenue to continue making future home loan repayments, as well as paying off any type of late settlements over the program of your repayment plan.

The audit can delay any type of financial debt alleviation by numerous weeks. That you made it this far in the process is a good sign at the very least some of your debts are eligible for discharge.